Bitcoin

Bitcoin

Bitcoin

Breaking Down Barriers

Not long ago, searching “Bitcoin” on your company network would trigger an instant firewall alert, maybe even a visit from IT. That’s changing fast. The companies losing out are the ones that still can’t have a conversation about it. But, what is Bitcoin really?

It’s a Payment System, First and Foremost

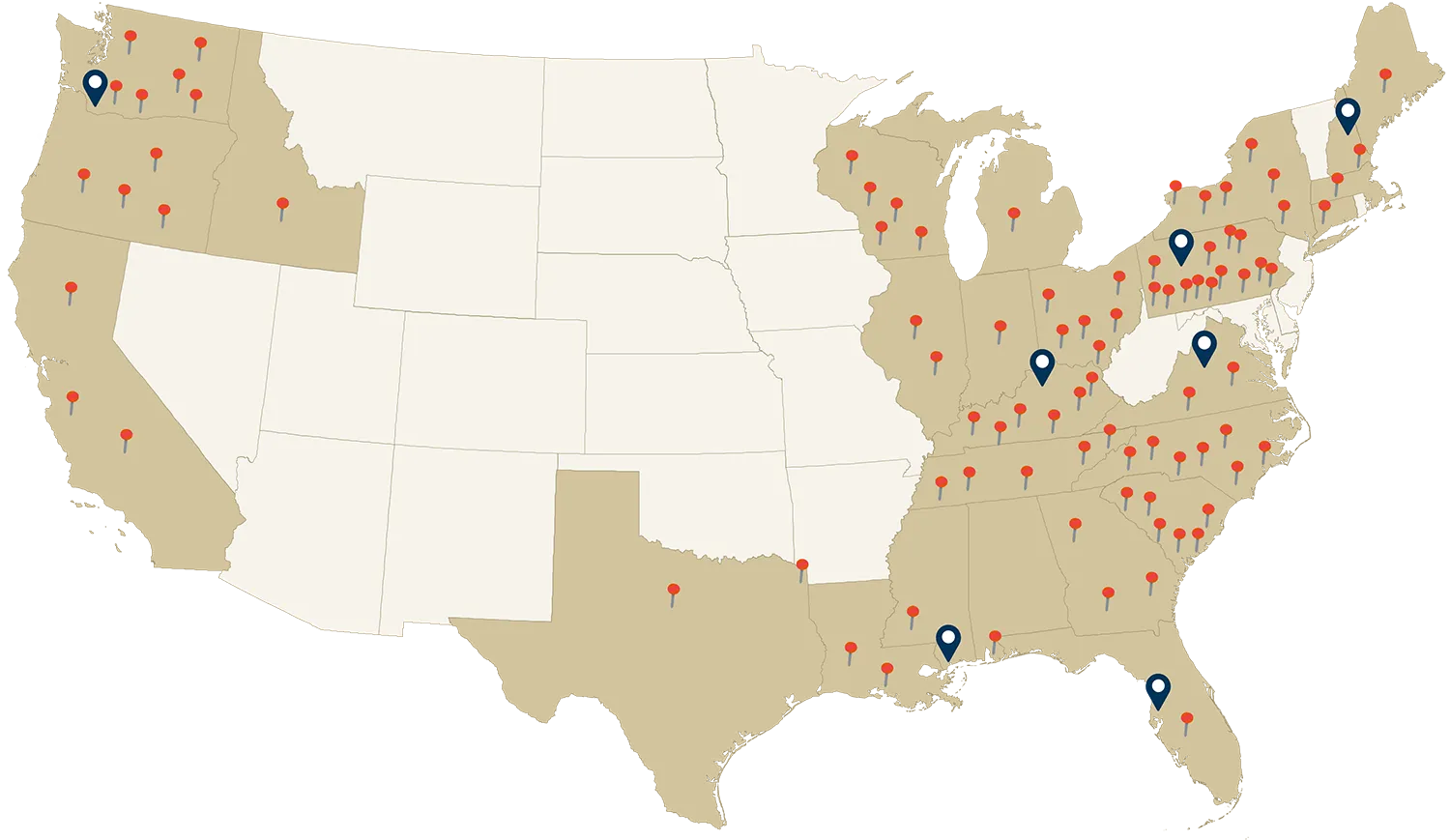

World governments are talking about it. Financial Systems and asset managers are moving into it. Over 200 publicly traded companies now hold Bitcoin in their treasury, , up from one in 2021 and up from less than a dozen in 2024. Some countries have already adopted it as a national reserve, and multiple U.S. states are establishing Bitcoin reserves.

Forget the hype, Bitcoin is a successful payment system.

This isn’t about politics or privilege. It’s not left versus right, rich versus poor, or one country versus another. It’s about the most secure and reliable payment system in existence, one that’s been running 24/7 without downtime or compromise since its creation 16 years ago. With it, you’ll have near instant settlement that is verifiable and incredibly cost-effective.

Treasury Asset

Why Businesses Are Making the Switch

Chris, our founder, experienced this firsthand: “In 2020 I made a company transaction in Bitcoin for $250,000 on a holiday. It cost $0.09 and took about 10 minutes. If I still had the Bitcoin I sent that day it would be worth close to $2,000,000. It will continue to work incredibly well as a store-of-value and treasury asset because it is being adopted for its incredible core value and efficiency at being a successful payment system.”

Compare that to your wire transfers. Here’s what most people don’t realize: those banking fees get built into prices by stores and manufacturers. We all pay extra as consumers. Bitcoin eliminates the middleman entirely.

Need to move significant capital across borders? Bitcoin does it in minutes for pennies. Every industry has waste energy, and Bitcoin mining offers a way to monetize it. Want to keep transaction fees on your balance sheet instead of paying intermediaries?

Banks have figured this out. They’re now racing to adopt the technology instead of fighting it.

“I’ve been laughed at, ridiculed, and ignored. I’ve also been listened to, sought out, and appreciated, none of which matters. Bitcoin, simply, is the most reliable, secure protocol in existence and, though 16 years old, is just getting started. It’s the adoption rate and the speculators that cause the price fluctuations, and that can be managed to your benefit.”

Chris Vaneman

President